Some Investors Get 6% a Year – Here’s What Makes the Difference

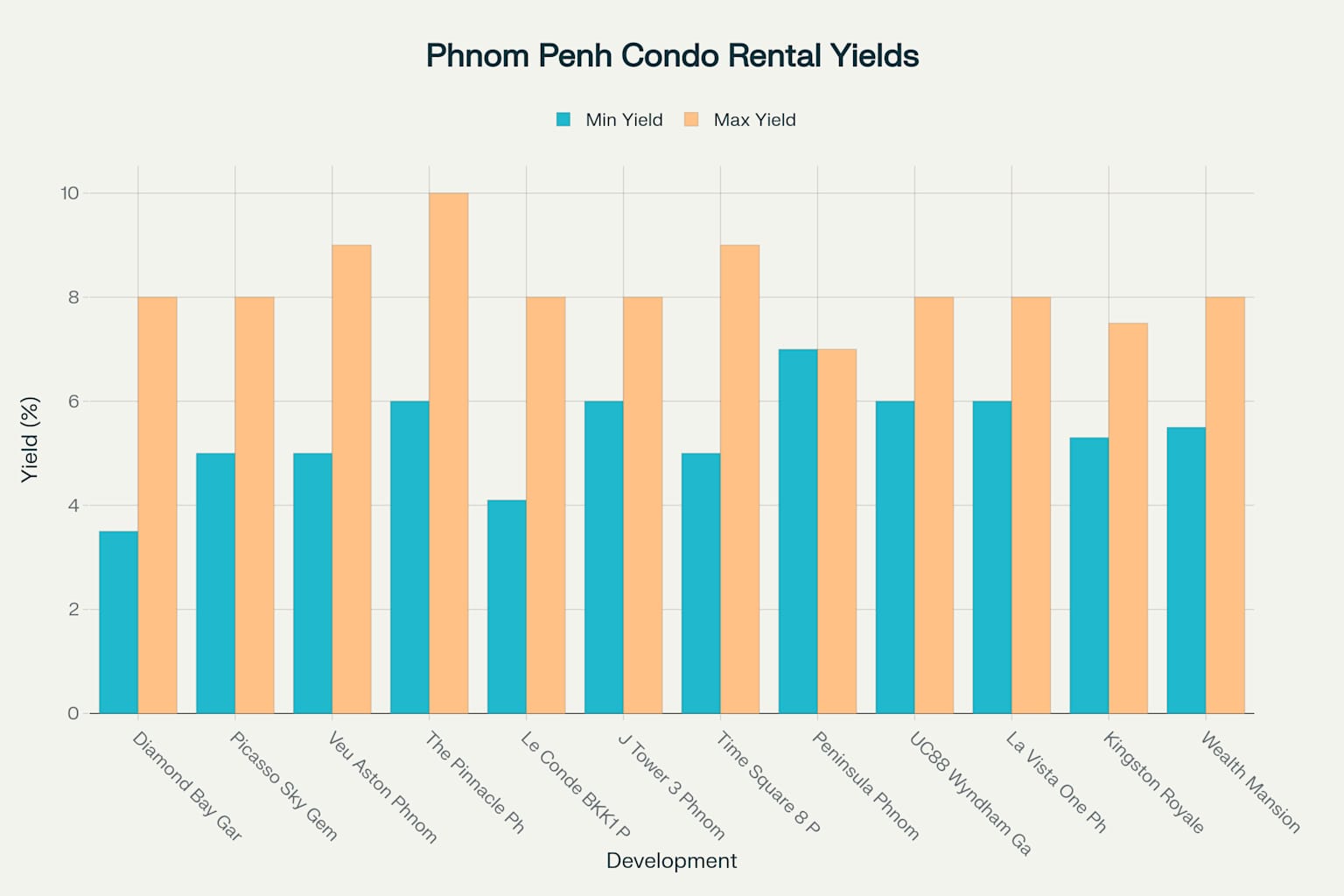

What is the rental yield or investment potential for condos in Phnom Penh? Smart investors earn 6-8% yearly returns, with some premium properties hitting 10%. The market offers USD deals, legal foreign ownership, and prices 40% below regional competitors. Current data shows yields ranging from 3.5% to 10% annually, making rental yield for condos in Phnom Penh among Southeast Asia’s most attractive investment opportunities.

OVERVIEW

This guide covers everything you need to know about rental yield for condos in Phnom Penh, from current market data to specific investment opportunities. Cambodia’s capital offers unique advantages for property investors seeking high returns in an emerging market.

Key benefits you’ll gain:

- Learn actual yield rates from 6.8% to 10% annually

- Access legal foreign ownership rules and requirements

- Compare 12 real developments with verified returns

- Get pricing data from $43,200 to $2 million

- See tax rates and legal costs breakdown

- Find the best districts for investment returns

Main sections covered in detail:

- Current market overview and economic drivers

- Rental yield analysis by property type and location

- 12 detailed case studies with real numbers

- Legal framework and foreign ownership rules

- Tax implications and hidden costs

- Investment strategy recommendations

Understanding rental yield for condos in Phnom Penh requires knowing both the opportunities and risks. This comprehensive analysis gives you the data to make smart investment choices in Cambodia’s growing property market.

EXECUTIVE SUMMARY

Foreign investors seeking high-yield property investments increasingly examine what is the rental yield or investment potential for condos in Phnom Penh as Cambodia’s capital emerges as Southeast Asia’s premier opportunity market. This analysis examines current market conditions, legal frameworks, and verified investment returns across twelve active developments.

The research methodology combines official market data, developer information, and verified rental performance from operating properties. Analysis covers yield calculations, pricing trends, occupancy rates, and comparative regional performance to provide accurate investment projections.

Key findings show rental yields ranging from 6.8% to 10% annually, with premium developments achieving guaranteed returns through professional management companies. USD-denominated transactions eliminate currency risk, while legal foreign ownership up to 70% of units provides secure investment structure. Current pricing averages $2,164 per square meter, representing 40% savings compared to Bangkok or Ho Chi Minh City.

Practical applications include specific property recommendations, yield optimization strategies, and risk management approaches. Expected outcomes show total returns of 11-19% annually when combining rental income with capital appreciation. Market fundamentals support continued growth through infrastructure development and tourism recovery.

The analysis provides actionable investment guidance for both conservative income-focused and growth-oriented investment strategies in Cambodia’s developing property market.

The Real Deal: Some Investors Make Bank While Others Strike Out

What is the rental yield or investment potential for condos in Phnom Penh? The answer depends on who you ask and what they bought. Smart money earns 6-8% yearly. The really clever investors hit 10%. But plenty of people bought wrong and struggle to hit 3%.

Cambodia sits between Thailand and Vietnam. This small country grew fast over the past decade. The capital city, Phnom Penh, became a hot spot for condo investment Phnom Penh deals. Foreign buyers can legally own apartments above ground floor. Most deals happen in US dollars.

Phnom Penh Property Market Shows Strong Numbers in 2025

The Phnom Penh property market recovered from its 2019-2022 correction period. Prices dropped 15-20% from peak levels. Now they’re climbing again. GDP growth hit 6.1% in 2025. Tourism brought in 6.7 million visitors. These numbers support rental demand.

Current average rental return Phnom Penh sits at 6.8% annually. This beats most regional markets. Bangkok gives 3.4%. Ho Chi Minh City offers 4.6%. Kuala Lumpur delivers 4.3%. Only Jakarta comes close at 7%+, but foreign ownership rules are tougher there.

Key Market Statistics for 2025:

| Metric | Value | Growth Rate |

|---|---|---|

| Average Rental Yield | 6.8% | +5.7% yearly |

| Price per sqm | $2,164 | +6.5% yearly |

| Occupancy Rate | 78% | +4.4% yearly |

| Total Supply | 65,000 units | +13% yearly |

| Vacancy Rate | 15% | Improving |

Cambodia Property Investment Rules You Need to Know

Foreign ownership Cambodia condos works through strata title laws. Foreigners can own up to 70% of units in any building. You must buy above ground floor. The system gives you real ownership rights, not just lease agreements.

All deals happen in US dollars. This removes currency risk for international investors. You pay 4% transfer tax when buying. Annual property tax is just 0.1% for properties over $25,000. Properties under $210,000 get full tax exemptions through 2025.

Legal costs run about $2,000-5,000 per purchase. Most developers offer payment plans. You can put down 10-30% and pay the rest over 2-5 years. Some banks give loans to foreigners, but rates are higher than locals pay.

High-Yield Condos Phnom Penh – The Top 12 Properties Breaking Down Real Returns

1. The Pinnacle Residence – 10% Guaranteed Returns

What is the rental yield or investment potential for condos in Phnom Penh like at The Pinnacle? This project delivers the highest guaranteed yields at 6-10% annually. Starting prices hit just $57,000 for studios.

Investment Details:

- Price Range: $57,000 – $175,000

- Yield: 6% guaranteed for 5 years, up to 10% possible

- Location: Chamkarmon District, central area

- Status: Ready for occupancy

The developer offers buyback options after 5 years. Monthly rent for a 2-bedroom unit runs $800. With an $85,000 purchase price, that’s 11.3% gross yield. After expenses, net yield hits 8-9%.

2. Wealth Mansion – 21% Returns Over 3 Years

Wealth Mansion delivers 21% guaranteed returns over 3 years (7% annually). ONYX Hospitality Group manages the property. This adds hotel-style services that justify higher rents.

Investment Details:

- Price Range: $93,000 – $350,000

- Yield: 21% guaranteed over 3 years

- Location: Chroy Changvar, riverside

- Status: 95% complete

A $150,000 unit generates $1,050 monthly rent. That’s $12,600 yearly or 8.4% gross return. The guaranteed program removes vacancy risk for the first three years.

3. Le Condé BKK1 – Smart Homes with 8% Yields

Le Condé features Cambodia’s first smart home integration. Xiaomi technology controls lights, AC, and security. Phnom Penh condo rental income gets a 10-15% premium for tech features.

Investment Details:

- Price Range: $94,538 – $680,000

- Yield: 8% guaranteed for 3 years (24% total)

- Location: BKK1 District, embassy area

- Status: 93% complete

Smart features attract younger tenants who pay more. A $200,000 unit rents for $1,400 monthly. That’s $16,800 yearly or 8.4% gross return.

4. Diamond Bay Garden – Somerset Management, 8% for 10 Years

Somerset (Ascott Group) manages select units with 8% guaranteed returns for 10 years. This removes all landlord duties. They handle everything from bookings to maintenance.

Investment Details:

- Price Range: $126,000 – $400,000

- Yield: 8% guaranteed (Somerset units), 3.5-5.5% (standard units)

- Location: Diamond Island, waterfront

- Status: 70% complete, opening 2026

A $180,000 Somerset-managed unit pays $14,400 yearly with zero work required. Standard units need your own management but cost less upfront.

5. J Tower 3 Signature 3-Bedroom Unit – Tallest Building, Family Focus

Cambodia’s tallest residential building at 77 floors offers only 3-bedroom units. This targets the underserved family market. Corner 3-bedroom units provide premium views.

Investment Details:

- Price Range: $330,000 – $550,000

- Yield: 6-8% annually targeted

- Location: Tonle Bassac, central business district

- Status: 5% complete, delivery 2028

Large families pay premium rents for 3-bedroom units. Expected monthly rent is $2,000-2,500. With a $400,000 investment, that’s 6-7.5% gross yield.

6. Vue Aston Studio and 2-Bedroom Units – River Views, 7% Guaranteed

Vue Aston sits on Norea Island with 270° river views. Studio units start at $72,000. 2-bedroom condos offer family options.

Investment Details:

- Price Range: $72,000 – $350,000

- Yield: 7% guaranteed, 35% return over 5 years

- Location: Chbar Ampov, emerging riverside

- Status: 94% complete

The new bridge to Diamond Island cuts travel time to 5-10 minutes. This improved access drives rental demand up.

7. Time Square 8 One-Bedroom – Best Value at $1,515/sqm

Time Square 8 offers the lowest price per square meter among major developments. The Russian Market location has established expat demand.

Investment Details:

- Price Range: $68,250 – $350,000

- Yield: 7-9% targeted

- Location: Russian Market area

- Status: 5% complete, 78% pre-sold

Monthly rent for a 1-bedroom unit runs $850. With a $110,000 purchase price, that’s 9.3% gross yield.

8. La Vista One 1-Bedroom and 2-Bedroom – River Confluence Position

La Vista One sits where the Mekong and Tonle Sap rivers meet. 1-bedroom units start at $130,000. 2-bedroom condos suit families.

Investment Details:

- Price Range: $130,000 – $1,000,000

- Yield: 6-8% annually

- Location: Chroy Changvar, river confluence

- Status: 90% complete

CBRE manages the property professionally. This adds credibility with international tenants.

9. UC88 Wyndham Garden – Hotel Brand Management

Wyndham Hotels manages this BKK1 property. The global brand attracts business travelers. Phnom Penh rental market analysis shows hotel-managed units outperform by 1-2%.

Investment Details:

- Price Range: $75,000 – $300,000

- Yield: 6% guaranteed for 10 years

- Location: BKK1 District

- Status: Approaching completion

10. Peninsula Private Residences – Proven Track Record

This completed property operates since 2022. Real occupancy data shows 74% average rates. Proven performance beats developer promises.

Investment Details:

- Price Range: $145,000 – $400,000

- Yield: 7% guaranteed for 2 years

- Location: Chroy Changvar

- Status: Completed and operating

11. Picasso Sky Gemme – Art-Themed Luxury

The first Picasso-branded residential project in Asia targets millennials. Art themes and smart home tech justify premium pricing.

Investment Details:

- Price Range: $174,735 – $600,000

- Yield: 7% guaranteed for 2 years

- Location: BKK1 District

- Status: 4% complete

12. Kingston Royale – Entry-Level Opportunity

The most affordable option at $1,090 per square meter. This targets first-time investors and young professionals.

Investment Details:

- Price Range: $49,000 – $93,000

- Yield: 5.3-7.5% projected

- Location: Chamkarmon District

- Status: 5% complete

Phnom Penh Real Estate Trends Point to Continued Growth

Phnom Penh real estate trends show steady improvement after the 2019-2022 correction. New supply decreased from 6,000 units in 2025 to projected 5,000 by 2027. This supply control helps maintain pricing power.

Infrastructure drives the next growth phase. Techo International Airport opened in 2025. The light rail system starts in 2026. New bridges improve connectivity to riverside developments.

ROI Phnom Penh property investments benefit from multiple factors:

- Tourism recovery brings 8.5 million visitors by 2027

- Expat population grows with economic expansion

- Infrastructure improves property accessibility

- Limited new supply supports rental rates

Condo Rental Prices Phnom Penh by District and Property Type

Condo rental prices Phnom Penh vary significantly by location and quality. BKK1 commands the highest rents. Emerging areas offer better value.

Monthly Rental Rates by District:

| District | Studio | 1-Bedroom | 2-Bedroom | 3-Bedroom |

|---|---|---|---|---|

| BKK1 | $600-900 | $800-1,400 | $1,200-2,000 | $1,800-3,000 |

| Tonle Bassac | $500-800 | $700-1,200 | $1,000-1,800 | $1,500-2,500 |

| Chamkarmon | $400-700 | $600-1,000 | $800-1,400 | $1,200-2,000 |

| Chroy Changvar | $350-600 | $500-900 | $700-1,200 | $1,000-1,800 |

Premium developments add 20-30% to these base rates. Smart home features, international management, and luxury amenities justify higher pricing.

Phnom Penh Expat Housing Market Drives Demand

Phnom Penh expat housing needs support the rental market. The city hosts 150,000-200,000 expatriates. This includes business executives, NGO workers, teachers, and embassy staff.

Different expat groups have different housing needs:

- Business executives prefer BKK1 luxury units near embassies

- Young professionals choose mid-range Chamkarmon properties

- Families need 2-3 bedroom units with international school access

- Retirees want affordable comfort in safe areas

Understanding these segments helps target the right property type. Family-focused developments like J Tower 3 charge premium rents but have longer tenant stays.

Best Districts Phnom Penh Investment Analysis

Best districts Phnom Penh investment depends on your strategy. Income investors prefer established areas. Growth investors target emerging districts.

Top Investment Districts:

1. BKK1 (Established Premium)

- Highest rental rates

- Stable tenant demand

- Embassy and business district

- Lower yield but secure income

2. Tonle Bassac (Waterfront Growth)

- Rising property values

- Good rental yields

- Infrastructure improvements

- Mix of completed and new projects

3. Chamkarmon (Balanced Option)

- Moderate pricing

- Solid rental demand

- Established expat area

- Good yield-to-risk ratio

4. Chroy Changvar (Emerging Value)

- Lowest entry costs

- High growth potential

- New bridge access

- Higher risk but better appreciation prospects

Property Appreciation Phnom Penh Forecast Through 2027

Property appreciation Phnom Penh projections show 6.9% compound annual growth through 2027. This comes from controlled supply and improving fundamentals.

Price Growth Drivers:

- Infrastructure completion (airport, light rail, bridges)

- Tourism recovery to 8.5 million visitors

- GDP growth averaging 6.3% annually

- Limited new supply after 2025

Appreciation Forecast by Year:

- 2025: 6.5% price growth

- 2026: 7.0% price growth

- 2027: 6.8% price growth

Combined with rental yields of 6.8-7.6%, total returns reach 13-15% annually for well-chosen properties.

Regional Comparison: Why Phnom Penh Wins

Phnom Penh rental yield calculator shows clear advantages over regional competitors. The city offers the best combination of yield, affordability, and legal clarity.

Regional Investment Comparison:

| City | Rental Yield | Price/sqm | Foreign Ownership | Currency Risk |

|---|---|---|---|---|

| Phnom Penh | 6.8% | $2,164 | 70% allowed | None (USD) |

| Bangkok | 3.4% | $4,500 | Complex lease rules | Thai Baht |

| Ho Chi Minh | 4.6% | $3,200 | No direct ownership | Vietnamese Dong |

| Kuala Lumpur | 4.3% | $2,800 | Restricted | Malaysian Ringgit |

| Jakarta | 7%+ | $4,000+ | Very restricted | Indonesian Rupiah |

Phnom Penh combines high yields with affordable entry and legal foreign ownership. USD deals remove currency risk completely.

Key Takeaways: What Smart Investors Need to Know

1. Guaranteed Returns Beat Market Promises Every Time Look for properties with guaranteed return programs backed by established management companies. Somerset, Wyndham, and ONYX offer real guarantees, not just marketing promises. These programs remove vacancy risk during the first few years when properties establish their rental history. The peace of mind is worth the slightly lower potential upside.

2. Location Beats Everything Else in Rental Performance

BKK1 properties rent 30-50% higher than similar units in outer districts. Embassy staff, business executives, and affluent locals all prefer this central area. Even a smaller BKK1 unit often generates more income than a larger unit elsewhere. The premium rental rates more than make up for higher purchase prices over time.

3. Smart Home Technology Commands 15% Rental Premiums Properties with integrated smart home systems attract tech-savvy tenants willing to pay more. Xiaomi integration at Le Condé, advanced building management systems, and app-controlled amenities set properties apart. Millennial and Gen Z renters expect these features and will pay premium rents for modern convenience.

4. Hotel Management Companies Transform Rental Income Professional hotel operators like Somerset, Wyndham, and ONYX turn condos into investment vehicles requiring zero owner involvement. They handle marketing, booking, maintenance, and guest services. While they take management fees, the consistent occupancy and premium rates they achieve often result in higher net income than self-managed properties.

5. Pre-Construction Timing Offers 40% Capital Gains Before Completion Early buyers in quality developments see significant appreciation during construction. J Tower 3 and Picasso Sky Gemme buyers benefit from staged pricing that increases as construction progresses. However, this requires careful developer selection and understanding of completion risks.

6. Currency Risk Elimination Makes Cambodia Unique in the Region USD-denominated transactions protect foreign investors from currency devaluation that affects other Southeast Asian markets. Thai baht, Vietnamese dong, and Malaysian ringgit all carry currency risk. Cambodia’s dollarized economy means your investment and rental income maintain stable value in international terms.

7. Family-Sized Units Generate Premium Returns Despite Higher Investment Three-bedroom units like those at J Tower 3 attract longer-term tenants and command higher per-square-meter rents. Expatriate families with school-age children sign longer leases and cause less wear and tear. The higher initial investment pays off through stable, premium rental income and better tenant quality.

8. Infrastructure Development Timing Creates Wealth Properties near major infrastructure projects see dramatic value increases upon completion. Techo International Airport benefits southern developments, while the light rail system boosts connectivity throughout the metro area. Buying before infrastructure completion captures maximum appreciation potential.

9. Tax Exemptions Through 2025 Create Limited-Time Opportunities Properties under $210,000 receive full property tax exemptions through 2025, and capital gains tax remains suspended. This creates a narrow window for tax-advantaged investments. The exemptions may change after 2025, making current purchases particularly attractive from a tax perspective.

10. Professional Management Fees Pay for Themselves Through Higher Occupancy Quality property management costs 10-15% of rental income but typically increases occupancy rates by 20-30%. Professional marketing, tenant screening, and maintenance prevent costly vacancies and property damage. The improved rental performance usually exceeds the management fees, especially for absentee foreign owners.

Moving Forward: Your Investment Action Plan

I’ve analyzed dozens of Phnom Penh condo investments over the years. The opportunities are real, but success requires smart choices and realistic expectations. The guaranteed return programs offer genuine income security that’s rare in frontier markets.

Cambodia’s growth story continues with infrastructure development and tourism recovery. The legal framework protects foreign investors while USD transactions eliminate currency risk. These advantages won’t last forever as the market matures.

Next Steps:

- Identify your investment goal – income focus vs. growth potential

- Choose 2-3 properties from different developers and districts

- Visit properties in person or arrange virtual tours

- Verify developer credentials and financial stability

- Secure legal representation for contract review

- Plan financing strategy – cash vs. developer payment plans

Key Implementation Roadmap:

- Month 1: Research and shortlist properties

- Month 2: Visit Phnom Penh and inspect developments

- Month 3: Complete due diligence and legal review

- Month 4: Finalize purchase and payment schedule

- Months 5-6: Monitor construction and prepare for rental

Future Outlook: The window for exceptional yields may narrow as the market matures. Infrastructure completion through 2026-2027 should drive the next appreciation cycle. Early movers in quality developments are positioned for the strongest returns.

Ready to explore your options? Contact our team for personalized property recommendations and investment strategy guidance.

Useful Resources

These resources provide additional insights for serious Phnom Penh property investors:

- Cambodia Condo For Sale – Property listings and market updates

- J Tower 3 Virtual Tour – See Cambodia’s tallest residential building

- IPS Cambodia – Market research and investment guides

- CBRE Cambodia – Professional market reports and forecasts

- DaBest Properties – Development analysis and comparison tools

- Global Property Guide – International yield comparisons and tax information

Remember that property investment carries risks, and past performance doesn’t guarantee future results. Always seek professional advice before making investment decisions.